AWS x Aella Credit: Infusing Intelligence into Financial Services

For decades, financial services have existed behind locked doors—accessible to some, out of reach for many. In Africa, nearly 70% of the population was invisible to lenders. No credit history. No formal banking. No way to prove who they were. Aella Credit set out to change that. And with AWS, they rewrote the rules while building something entirely new.

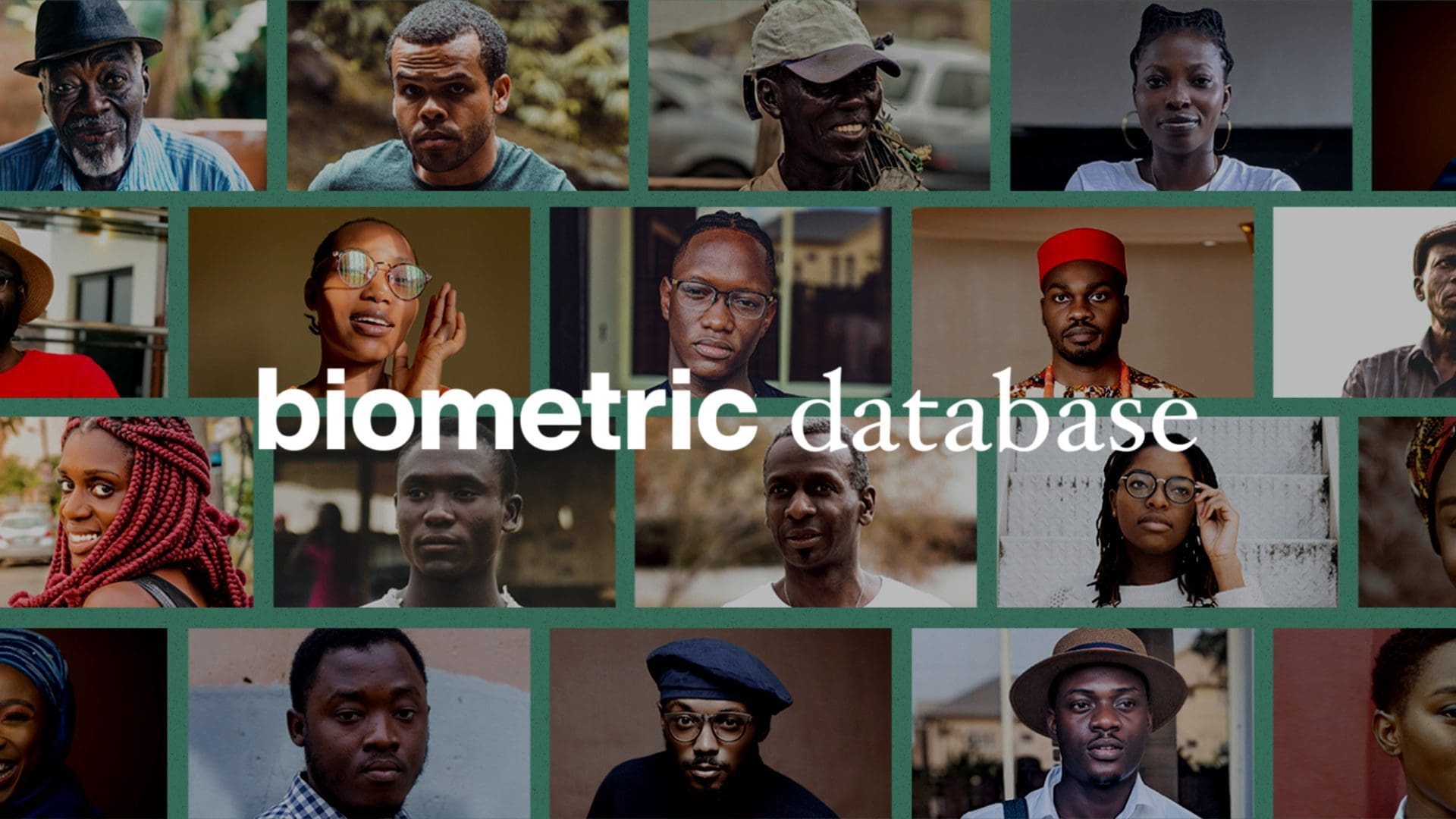

Verifying the Unseen

With only 38% of Nigerians having formal identification, Aella Credit and AWS are building cloud-powered biometric verification systems to enable financial access for millions previously excluded from traditional banking. Featured in AWS x Aella Credit’s financial transformation initiative.

The first challenge was identity. In a world without comprehensive ID systems, how do you verify someone who exists outside of databases, records, or traditional financial footprints?

Aella Credit’s answer was biometric verification at scale. By integrating into national identity registries and moving that data to the cloud, they created a new kind of financial passport—one built on real-time authentication, not outdated paperwork.

Aella Credit leverages AWS-powered biometric verification to create a secure and scalable identity system, enabling financial inclusion for millions previously excluded from traditional banking. Featured in AWS x Aella Credit’s financial transformation initiative.

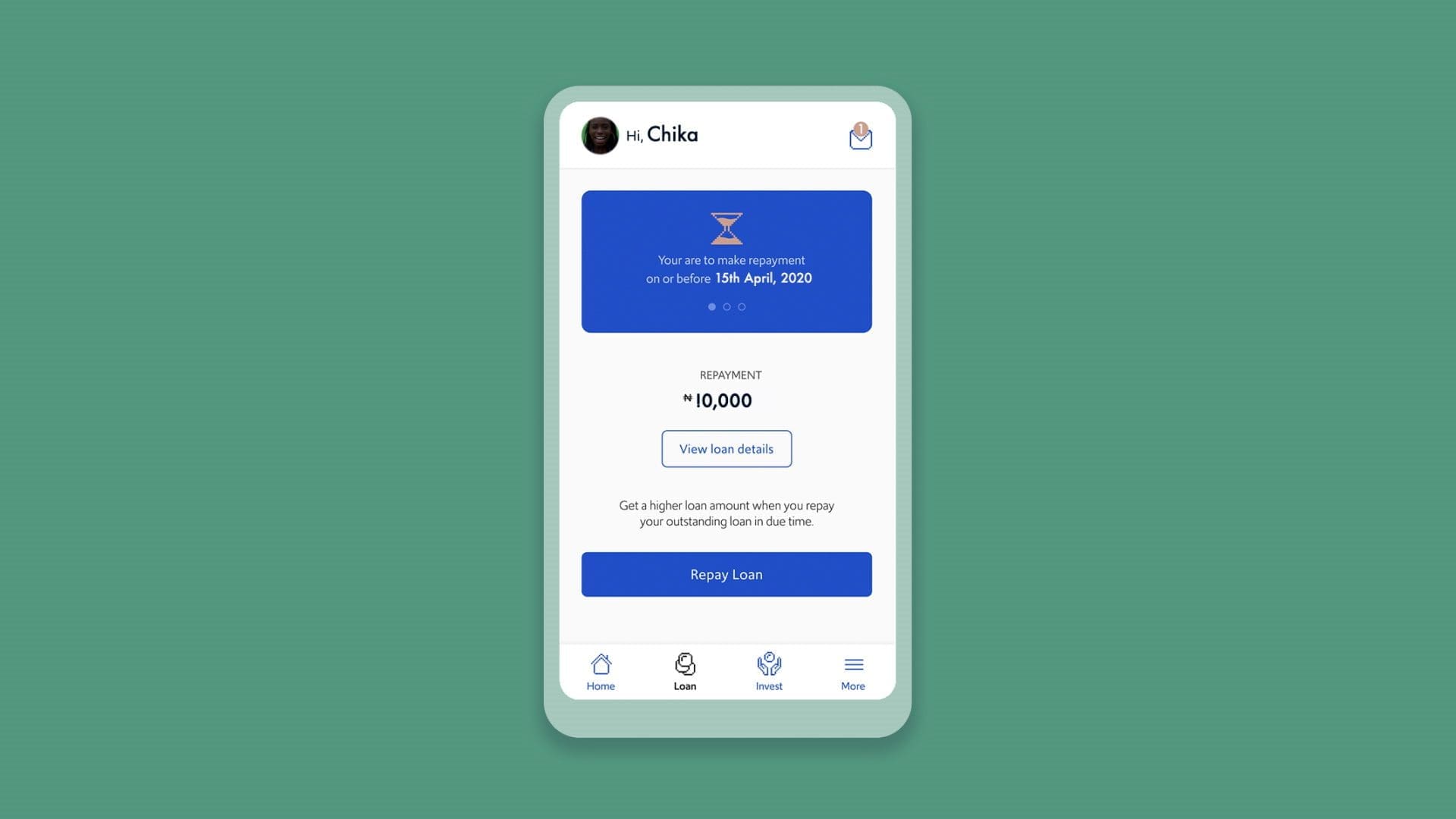

From a Month to a Few Seconds

What once took weeks—verifying an individual, ensuring they were who they claimed to be—now happens in seconds. AWS Rekognition fuels Aella’s facial recognition system, performing a proof-of-life check: a series of gestures, multiple image captures, cross-referenced with government records.

If it matches, access is granted. If it doesn’t, fraud is stopped before it begins.

The result? A system that scales at the speed of ambition—fast, secure, and built to empower, not exclude.

Aella Credit’s AI-driven digital lending platform, powered by AWS, provides instant loan approvals and seamless repayment tracking, creating financial opportunities for underserved communities. Featured in AWS x Aella Credit’s financial innovation initiative.

Microloans. Macro Impact.

The ripple effect is profound. A farmer in a remote village borrows enough to buy a few cows. He sells them, buys more, reinvests. Soon, he’s not just supporting his family—he’s creating jobs.

Aella Credit’s microloan program, powered by AWS, helps small business owners secure funding, invest in livestock, and create new economic opportunities. Featured in AWS x Aella Credit’s financial inclusion initiative.

The number one use of Aella’s loans? Small businesses. AWS-powered intelligence isn’t just opening doors—it’s building entire economies.

For Aella, growth meant scale, and scale meant finding a system that could keep up. AWS was that system. Cloud computing allowed them to process millions of data points without breaking. AI-driven verification ensured security without friction. The invisible became visible. The excluded became included.

Finance was never meant to be a luxury. Now, with AWS and Aella, it isn’t.